‘Uberization’ of financial services: How technology is driving financial inclusion in India

Universal access to financial services is a key ingredient for achieving socioeconomic development. Financial inclusion is a theme that is particularly relevant for India, where around 21% of the world’s unbanked population resides. Until recently, financial inclusion initiatives have been entirely bank-led, with very limited participation of non-bank players. However, the low risk-appetite and asset-heavy model of banks have restricted wider coverage and penetration has been limited. Even in the cities with strong brick-and-mortar infrastructure, the frequency of transactions using bank accounts has been low, with more than 40% of accounts lying dormant.

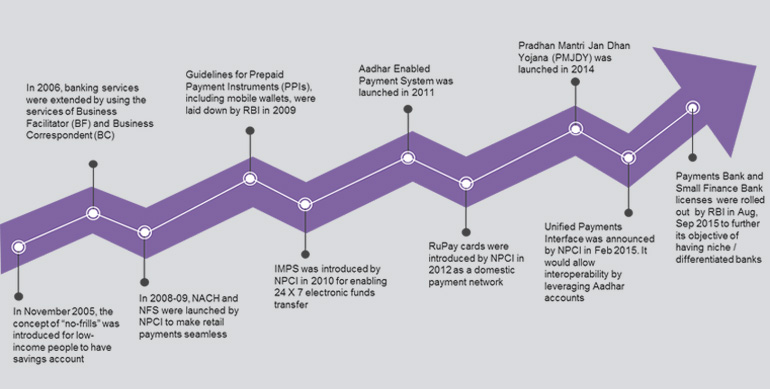

Recent years have seen a big push towards digital financial inclusion, spearheaded by RBI and NPCI. The following timeline presents landmark policy measures in India’s path to achieving financial inclusion:

Complementing the regulatory push is a market-led pull by FinTech startups that have mushroomed across India. The convergence among banks, telecom players and technology startups is paving the path for higher integration and innovation. Development in mobile telephony, the government’s increased focus on financial empowerment of the under-banked, and a vibrant entrepreneurial community are together leading to the emergence of a digital finance ecosystem. Just as cab-aggregator Uber has turned the taxi industry on its head through an innovative platform model, FinTech startups are challenging the status quo and causing disintermediation in the banking industry. The young FinTech startups have forced mammoth banks to re-think their strategy, re-orient their business model and redesign their technological capability.

Sitting on the cusp of a revolution

Agility and innovation are the factors that set FinTech startups apart from the ‘too big to change’ banks. FinTech startups are fundamentally technology-led, unlike banks that are deposit-led. The FinTech startups have ‘out-of-the-box’ business models and leverage technology to deliver financial services in a cost-effective, swift and convenient manner. Hence, they can potentially enable last-mile reach to the financially excluded population through alternative digital channels, which is more scalable than the legacy high-touch model of banks. For millions of financially excluded Indians, the gateway to financial services may not be traditional bank branches but access points such as mobile wallets and POS machines. This opportunity to deliver financial services at high scale and minimal operating costs has a huge potential for a larger impact to society.

In India, the process of ‘uberization’ of financial services is being catalyzed by the following five trends

Demographic dividend: More than 65% of India’s population is under the age of 35 years and more than 50% smartphone users in India are aged between 18 and 30 years. These consumers are tech-savvy and ready to experiment with unconventional digital financial services products that promise speed and convenience.

Internet-enabled mobiles: A majority of the low-income population in India is leapfrogging into internet usage via mobiles, bypassing fixed line internet. The increasing affordability of mobile phones and decreasing cost of data has resulted in a highly digital populace. The emergence of smartphones is enhancing mobiles from a simple communication device to a full-fledged payment device.

JAM Trinity: Jan Dhan–Aadhar–Mobile is a win-win combination that has created the building blocks for a cashless pathway to financial inclusion. Mobile phone, bank account and unique digital IDs are the pillars on which the DFS environment is being built in India.

E-commerce boom: The rapid growth in e-commerce has seen lakhs of proprietors and wholesalers become online sellers. It is estimated that every month roughly 30,000 retailers are inducted as online sellers on e-commerce platforms This offline-to-online migration is enabling FinTech companies to tap into the digital trails of these merchants – social media footprint, customer ratings/reviews, purchase history and other factors – and make credit decisions based on machine learning algorithms.

Significant advancement in ICT: Higher computing capability and storage capacity have given rise to ‘big data’ analytics, facilitating better risk assessment and trend discovery. The access to wider and richer consumer data has allowed players to extract behavioral insights and develop targeted solutions. The SMAC (social media, mobile, analytics and cloud) and API technologies have allowed different data streams to ‘talk’ to each other in a highly efficient manner. This has led to the amalgamation of multiple services into a common platform, thus creating different use cases for delivery of financial services and a parallel ‘app economy’.

Striking while the iron is hot

FinTech startups are present across the entire gamut of financial services in India, with most of them operating in the payments space. Presently, a majority of the present customer base of these payment service providers includes only the banked population. This is because cash-in and cash-out are presently largely restricted to the banking system (net banking, credit/debit cards). The introduction of payments banks, however, will soon change the game and allow lakhs of retail merchant points to act as agents for cash in/out. These niche banks have a huge opportunity to collaborate with the main banks and digitize their distribution model by acting as business correspondents.

The latest mega-news of the launch of Unified Payments Interface (UPI) by RBI and NPCI is a huge step in enabling cashless micropayments. UPI will make payments across multiple partner banks much faster, more convenient and seamless. One unique digital ID will replace the multiple steps that the present IMPS and NEFT transfers entail. The expected onboarding of payments banks and mobile wallets into the platform will drastically boost interoperability (W2W, B2B, W2B, B2W) and reduce commission structures, breaking the cost barrier of digital transactions for the low-income consumers.

Gazing into the crystal ball

With the maturity of the ecosystem, FinTech startups will lead the way to India’s financial inclusion. The usual ‘banked’ criterion for financial inclusion is set to undergo a paradigm shift, with financial services such as digital remittance, credit, insurance etc. available to consumers even without accounts in the commercial banks. With a billion mobile subscriptions and a billion Aadhar IDs created, financial services through mobile phones is expected to dominate all other channels.

The success factors for FinTech players in India will be the usability, affordability, reliability and ubiquity of their services. To ultimately benefit consumers at the grassroots level, financial literacy and awareness among low-income customers would be paramount. Trust factor will also play an important role, especially to mobilize rural and semi-urban consumers to transition into digital channels. Hence, transparency in fees, easy recourse in case of fraud, and multi-lingual customer service will have to be institutionalized by all FinTech players. Product design, cost of transaction, speed and interoperability will be the levers on which FinTech players would be able to differentiate their offerings.

People will no longer have to stand in queues to pay bills or send cash back home. People in remote places will soon be able to replace cash with mobile money for bill payments and remittance. Lakhs of mom-and-pop shops and kirana stores are going to function as micro ATMs where withdrawal, deposit, fund transfer and eKYC can take place, complementing ATMs. With mobile wallets and payments banks starting to target to the online-to-offline business, the era of plastic cards will soon be a thing of the past. For example, payments banks will be able to issue virtual cards, and with the help of a QR scanner, consumers will be able to pay at merchant locations through their smartphones. Even ATMs are experimenting with cardless cash withdrawal and remittance. Given the high awareness of social media even in the hinterlands of India, FinTech startups will use Facebook or WhatsApp in a big way to source customers and enable micro P2P payments for remote populations. The future will also see cryptocurrencies, contactless payments, biometrics and IoT reshape the market in ways one may never have imagined.

With the confluence of finance, technology and innovation, the possibilities are endless, but imagining millions of Indians into the formal financial system has now become much easier. Last year, Infosys co-founder and former UIDAI chief remarked that ‘India is witnessing a WhatsApp moment in finance’, drawing an analogy between how WhatsApp disrupted the telecom sector and how FinTech is transforming the financial sector. Right now, ‘co-opetition’ is the mantra adopted by FinTech startups and banks to co-exist and find synergies with each other. However, it won’t be long before non-bank FinTech startups become mainstream and, rather than piggybacking on the banks, start competing with the incumbent banks on end-to-end delivery of financial services.

This will be India’s ‘Uber’ moment in finance.

Rishabh Parakh, Associate, Business Consulting, Intellecap Advisory Services Pvt Ltd

Rishabh is focusing on assignments in financial inclusion. He is a ‘FinTech evangelist’ and strongly believes in the disruptive power of technology to enable people to do more. He is excited about IoT and block chain technology in payments. His past professional experiences include product management, business analytics, regulatory compliance and equity research. He holds a Master degree in Economics from BITS Pilani and is a CFA Level III Candidate.