The End of a Debate? India Highlights the Dominance of For-Profit Capital in Impact Investing

Can impact investing be as commercially viable as mainstream investing – or does it work better as a nonprofit model, or as a less-profitable niche in the broader investing space? This question remains widely debated, even as more and more empirical evidence has demonstrated the commercial success of impact investments across the globe. However, an analysis of the evolution of the impact investing sector in India suggests that this long-running debate may be winding down, as a clear consensus emerges.

Though both nonprofit and for-profit approaches have contributed to the growth and success of the impact investment space, for-profit capital has far overtaken philanthropic capital – in India and beyond.

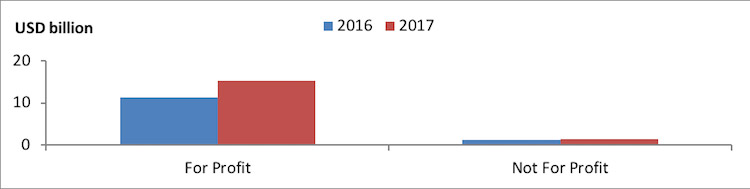

According to GIIN’s 7th Annual Impact Investor Survey, the total capital invested so far in the impact space stands at US $181 billion and the total planned investment for 2017 is expected to be at US $25.9 billion. That constitutes a 17 percent rise from 2016, and the share of for-profit capital invested by fund managers in this total is expected to be almost 60 percent, with fund managers’ not-for-profit capital investments at around 5 percent. It is interesting to compare the growth seen in both of these pools of capital over the last year (see table below). While the growth in the not-for-profit pool has been stagnant, the for-profit pool is expected to see a 35 percent gain.

Impact investing in India

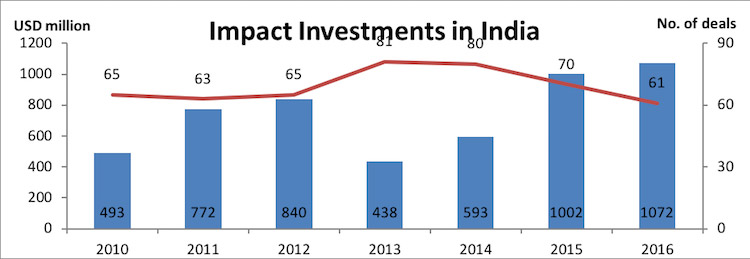

Meanwhile, in India, the demographic dividend of a young population with higher disposable income and consumption has combined with socio-economic disparities to provide a large opportunity for the social sector to play a role in inclusive growth and sustainable development. Hence, it is not a surprise that the country has attracted US $5.2 billion in impact investments since 2010 and is emerging as an attractive market for social investors.

India has witnessed an increasing number of deals year-after-year in the impact space, but with enterprises showing strong growth, the average deal size has also grown from US $7.6 million in 2010 to US $17.6 million in 2016. Investor interest has been further boosted by the strong exits witnessed in this space. A recent McKinsey analysis of exits between 2010-2015 showed a median internal rate of return (IRR) of 10 percent, with the top 30 percent of deals providing 34 percent IRR – all of this while creating favorable social outcomes.

The Example of Microfinance

The Indian microfinance sector is a good example of how the narrative of impact investments went from purely social outcome-based to strong commercial-based models. Microfinance initially started as a not-for-profit model trying to solve the problems of bringing finance to the unserved masses at the bottom of the socio-economic pyramid, where traditional financial channels were unable to reach. But with the liberalization of the Indian economy in 1991, the microfinance sector witnessed strong growth. Private sector actors leveraged the self-help group lending model, and created business models that were commercially viable and scalable. The strong repayment rates among these (often women-directed) self-help groups, along with MFIs’ joint-liability lending model addressed credit-risk issues and increased the availability of capital in the form of credit from the private sector. Meanwhile, equity capital from investors – among them Caspian, Aavishkaar and Elevar – contributed to the growth of this space.

As of March 2017, the total gross loan portfolio of India’s microfinance sector stood at approximately US $16.4 billion, and it had attracted cumulative investments of approximately US $1.5 billion from April 2011 to that date. This represents almost 30 percent of the total impact investments in the country, and these investments have led to some of the most profitable exits by investors. For instance, impact funds Aavishkaar and Caspian (India Financial Inclusion Fund) saw 13x and 4.5x return, respectively, on their exit from Equitas through an initial public offering in 2016.

Impact in Other Sectors

Other sectors like agriculture, waste management and handicrafts have also witnessed investor interest following validation of scalable business models:

- Agriculture equipment rental company EM3 Agri Services has raised around US $14 million in the past three years. The company clocks monthly revenues of approximately US $150,000.

- Nepra, a waste management company offering collection and sorting of dry waste, has received around US $4 million in investment. The company has a processing capacity of 100 metric tons per day in the city of Ahmedabad, Gujarat.

- Companies like Fabindia and handicraft e-commerce marketplaces like Jaypore and Craftsvilla have garnered attention from the investor community, and each has raised institutional funding. These companies provide market access to artisans working across India who otherwise face dwindling incomes, and they have been instrumental in reviving some of the handicraft clusters in the country.

(Note: Aavishkaar has invested in Jaypore and Nepra.)

Conclusion

Social enterprises play an important role in meeting social objectives and impact funds perform the crucial function of providing risk capital to them. And for impact funds to have continued access to capital pools, they need to match the performance of mainstream private equity/venture capital funds in generating returns for investors. Impact funds can no longer survive while showing only favorable social outcomes without demonstrating comparable returns – and indeed, impact measurement itself has increasingly become commercial-metric driven, with impact-focused metrics coming in secondary. In India, impact investors like Aavishkaar have embraced this philosophy for years, seeing profitable exits that have made the case for commercial impact investing even stronger.

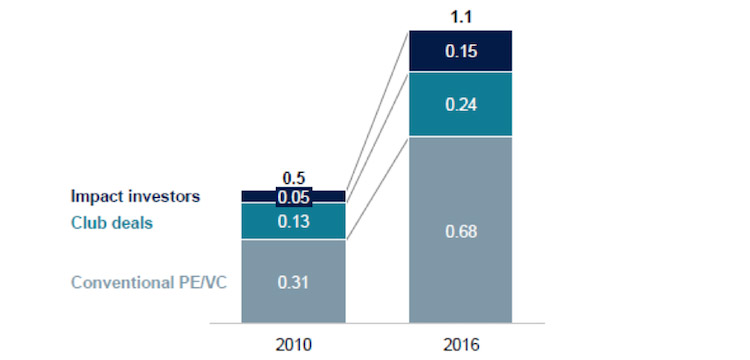

This growing evidence of profitability is reshaping (and perhaps ending) the long-running debate around impact investing’s commercial potential. In response, increasing numbers of mainstream private equity investors have started focusing on impact enterprises, including some that have created separate impact funds – from TPG’s US $2 billion global impact fund, RISE, to Abraaj Group and Goldman Sachs’ growing focus on their own impact strategies.

Due to the success of the impact investment space and the trend of more mainstream investors adopting stricter ESG mandates for their investments, the line between impact and traditional investing is blurring. If these trends continue, soon the classification of funds into impact and mainstream will be all but redundant.

Disha Gandhi is an investment manager at Aavishkaar Venture Management Services (AVMS) in the Mumbai office.

Top photo: Rohtash Mal, co-founder of EM3 AgriServices, which serves as an Uber-like rental service for farmers. (Image credit: EM3)