Innovation for Impact

How Whrrl is Transforming Agri-Finance with Blockchain-Powered Warehouse Receipt Lending

- Sector: Climate & Agriculture

- Sub Sector: Data-Smart Agriculture

- Geography: India, Asia

The Challenge:

A huge challenge in agriculture is that many smallholder farmers are forced into distress sales, dumping their produce at 30–50% below market value due to lack of storage, credit, and fair market access. Traditional warehouse receipt financing (WRF) systems are manual, prone to fraud, and exclude the most vulnerable farmers.

The Innovation:

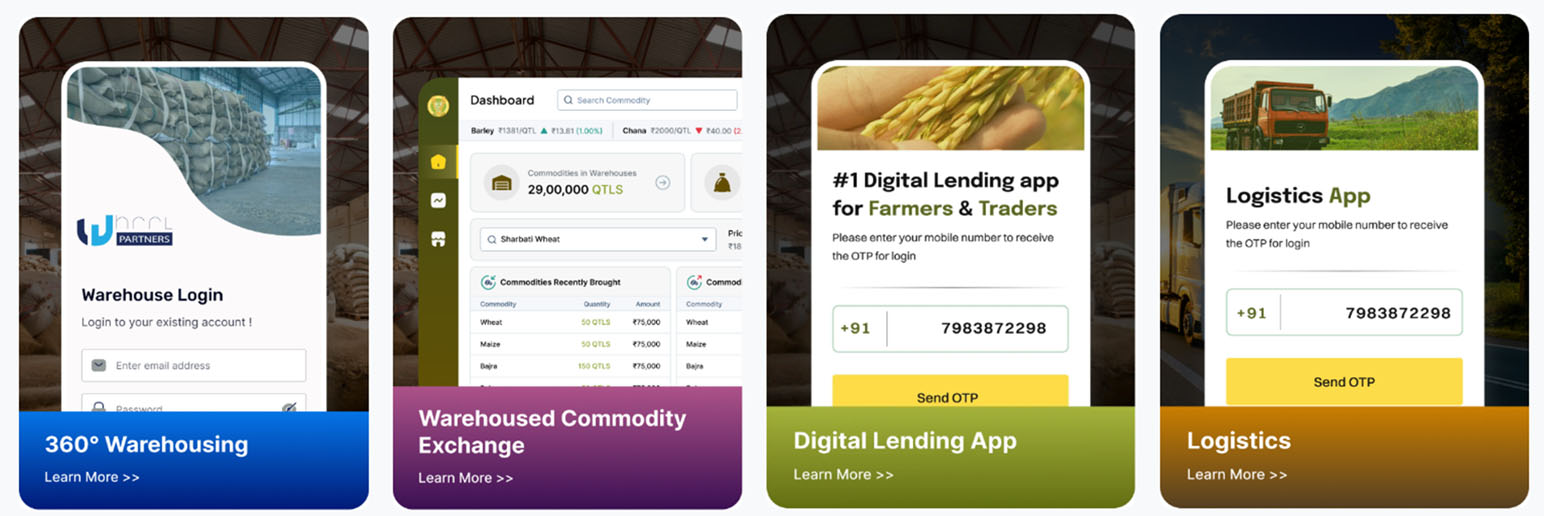

Whrrl has built a blockchain-powered warehouse receipt financing platform that transforms how farmers access credit and markets. When farmers store their produce in certified warehouses, they receive a digital, tokenized warehouse receipt recorded on blockchain. This acts as secure collateral, enabling them to get instant, low-interest loans without guarantors or traditional collateral.

The system uses AI/ML, IoT, and smart contracts to ensure transparency, prevent fraud, and automate loan disbursements. Farmers can also trade or sell their tokenized receipts through Whrrl’s integrated marketplace once prices rise, ensuring better income realization.

Whrrl’s innovation turns stored crops into financial assets, giving farmers liquidity, bargaining power, and resilience against post-harvest losses.

The Impact:

- Reduced distress sales by providing farmers with instant credit against stored crops.

- Tokenized over $800 million worth of commodities through blockchain.

- Disbursed more than $25 million in digital loans to smallholder farmers.

- Positively impacted over 70,000 farmers across seven countries.

- Scaled operations to more than 1,400 warehouses, strengthening storage and financing infrastructure.

- Increased trust and transparency in warehouse receipt financing through blockchain and IoT monitoring.

- Improved farmer incomes by enabling them to wait for better market prices instead of selling immediately after harvest.

South–South Agriculture Alliance: Inaugural Cohort & Its Impact

Whrrl is a proud member of SSAGA (South–South Agriculture Alliance), an initiative by Intellecap to support agritech startups in scaling across the Global South.

- Expanded into Kenya with SSAGA’s support, tailoring its blockchain-powered warehouse receipt financing model to meet the needs of smallholder farmers.

- Formed partnerships with five warehouses and built a pipeline of 6,000 farmers through farmer collectives.

- Secured in-principal approval from two financial institutions to enable affordable credit access.

- Leveraged SSAGA’s market insights, stakeholder connections, and grant funding to fast-track its go-to-market strategy by 6–9 months.

SSAGA has been instrumental in helping Whrrl establish a strong presence in East Africa, fostering partnerships and accelerating its mission to reduce distress sales and improve farmer incomes through blockchain-enabled post-harvest financing.

Looking Ahead: A Transparent and Inclusive Agri-Finance Future

- Efficient by digitising warehouse receipt financing with blockchain and smart contracts

- Sustainable by reducing post-harvest losses and strengthening storage infrastructure

- Inclusive by giving smallholder farmers affordable credit, fair market access, and better income realisation

With continued innovation and strong partnerships, Whrrl is set to lead the transformation of Agri-finance across emerging markets, ensuring farmers gain both resilience and prosperity.

If you are a startup and would like to know more about SSAGA, please write to us at