Aavishkaar Group to catapult into Asia, Africa with latest capital infusion

Mumbai, 14th October, 2019: In a significant coverage to the Aavishkaar Group post the US 37 Million (INR 260 crores) investment by Dutch Entrepreneurial Development Bank, Business Standard featured us in a detailed story titled, “Aavishkaar Group to catapult into Asia, Africa with latest capital infusion”.. The story written by Senior Journalist Anjuli Bhargava, talks about how with this infusion Group Founder and Chairman Vineet Rai attempts to make the next leap as the largest impact platform in the two continents.

The detailed article talks about the Aavishkaar Group which today has assets under management of Rs 6,700 crore. With the investment from FMO, Vineet shares how this latest infusion of capital will be used to catapult the impact fund business into a platform for impact investment in Asia and Africa, increase associates stake, capitalise the debt businesses and will help bring in the latest technology and best talent to grow the company.

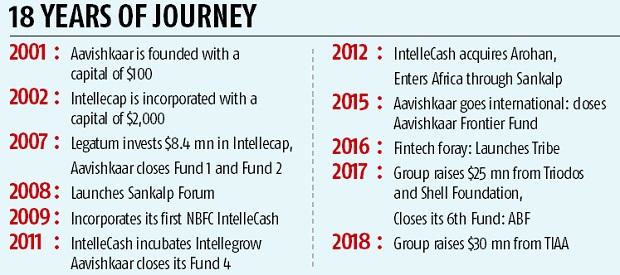

The journalist opines that to understand the leap that Vineet Rai is attempting to make, one needs to go back in time. The edifice on which the group stands today came up in 2001 with an investment of a mere $100. The company was incorporated based on the belief that if the capital is handed over to the right talent, it can solve many of the problems that low-income communities face.

In 2002, a second block was added to Aavishkaar. If those who have previously not been entrepreneurs have to turn entrepreneurial, they need someone to advise them. Intellecap, the advisory arm of the group, was added to the stable with a capital base of $2,000. The thinking was that you needed intellectual capital as well as financial capital to grow a business.

The business grew and, by 2007, Aavishkaar Capital had closed two of its funds (money was raised to be invested in social enterprises) and begun investing. In 2007, Dubai-based Legatum took a stake in Intellecap with an investment of just over $8 million. At the time, around 2006-08, micro finance itself was in its early stages and social impact companies were virtually unknown in the Indian landscape.

To grow, these companies needed both equity and debt funding. Intellegrow was incubated under the Intellecap umbrella to provide debt lending to small and medium enterprises.

Meanwhile, the group also acquired Kolkata-based Arohan (the NBFC crisis had happened and Arohan was sinking like many others) to provide equity funds to SMEs and subsequently retail micro finance. The gambit worked. Arohan’s Assets Under Management (AUM) has risen from Rs 28 crore at the time of acquisition to Rs 4,800 crore in seven years.

In 2008, aware that few understood the impact eco-system or what it was attempting, the group launched the Sankalp forum to bring together the world’s most promising entrepreneurs, most committed investors, policy makers, government officials, and others under one roof at least once a year.

By 2012, Aavishkaar felt ready to take its Sankalp forum to Nairobi in Africa, another emerging destination for impact finance. “At the time, impact investing was still an alien animal. Advocacy and a deeper understanding of the impact sector was and still is necessary for the space to thrive,” said Vineet.

Three years later, after having raised and invested four funds in social enterprises in India, the group raised the Aavishkaar Frontier fund of $48 million for investment in nine companies in Bangladesh, Indonesia and Sri Lanka. This was the first foray out of Indian shores.

More recently, the group has identified a new yawning gap and launched a fin-tech product – TRIBE – that uses technology to offer small loans to businesses in the informal segment. In general, micro, small and medium enterprises (MSMEs) are not catered to by banks due to the small size of their requirements, the banks’ limited ability to reach them and unproven credit history. Using technology, TRIBE reaches these tiny enterprises, offers them loans of the sizes they require, and collect enough data to assess their credit worthiness. “This helps us take credit calls on these enterprises,” explained Anurag Agrawal, Group Chief Operating Officer. Technology is also used to stay connected with the borrowers and to collect payments when due.

The author goes on to say that while Vineet and others argue that the MSME space is severely underfunded, Micro finance loans currently in India are in the range of Rs 2 lakh crore (lent by all MFIs in India) while it is estimated that the MSME market is ten times the size of the micro finance market but the penetration is currently one tenth. In other words, the upside for anyone who gets the model right is staggering. As a regional platform, the group is hoping to offer the full range of services that any enterprise focused on solving development issues might require.

Through Aavishkaar Capital, equity finance can be provided; Arohan (one of the fasting growing verticals) can offer micro loans of any amount; Intellecap can act as an advisor and provide intellectual capital to the enterprise; Sankalp brings all stakeholders together.

What gave the group the confidence to position itself as a regional platform arose from two factors. One, its business grew by leaps and bounds. While the group’s credit-based AUM rose from Rs 234 crore in FY14 to Rs 4,500 crore by FY19, its fee-based business rose from Rs 983 crore to Rs 2,200 crore in the same period. As of now, total AUM is roughly $1 billion. They hope to grow this to $7 billion by 2025.

Two, Aavishkaar was able to prove its basic premise to a large extent: companies can actually solve larger social problems while making money, one of the most controversial aspects of impact investing. The funds have been invested in over 60 companies, primarily in India. The 30-odd exits have resulted in returns of 3.7 times the capital invested. “We have been able to validate that the impact space works on commercial principles,” said Agrawal.

Three investments have been made in the platform as of now. In 2017, the group raised $25 million from Triodos and the Shell foundation. In 2018, it raised a further $33 million through TIAA, the world’s third largest pension fund, again at the holding company level. The latest investment of $37 million has taken Rai and his team and associates’ share in the group down to just over 51 per cent.

“My focus is on scale for now and this latest investment by FMO gives us the opportunity to walk on that path,” said Vineet. From a vision perspective, he says the group wants to work in Asia, Africa and Latin America, although it is yet to make any inroad into Latin America. For expansion into Africa, a team of 25 is now based there. In Indonesia and Bangladesh, it so far only has a few investment managers.

The question the impact sector is asking whether an impact investor can metamorphose itself into a platform for the region, straddling two continents. Sceptics argue that impact and all private equity investment is based on very deep embedded knowledge of the local environment and factors at play.

To invest in an enterprise in another country is one thing but having the local expertise to advise, guide and counsel social enterprises in an environment hitherto alien is easier said than done. So, Aavishkaar has taken on a big challenge. How far it manages to deliver is yet to be seen.

View full article