Assessing opportunities to Finance Women-led Micro- and Small-Enterprises in Southeast Asia

Client: Women’s World Banking

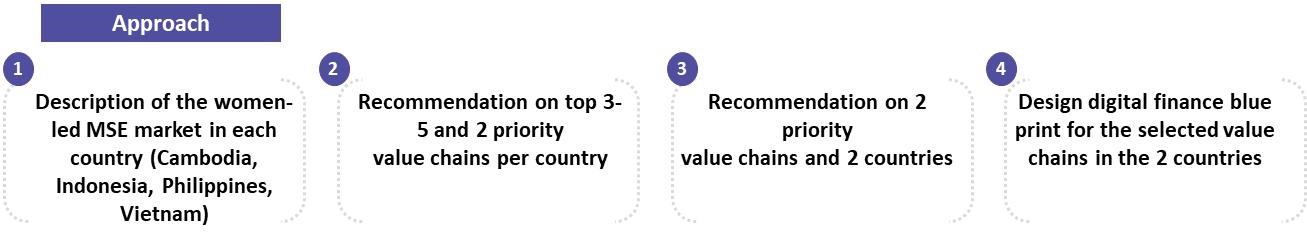

Challenge: The engagement required market analysis of key women-led micro- and small-enterprises (MSEs) in select value chains in Indonesia, Cambodia, Philippines and Vietnam and then designing a practical blue print that can improve access to finance for such enterprises.

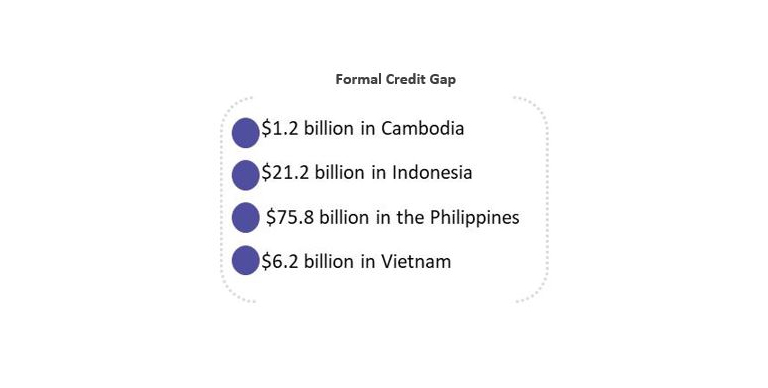

Women led micro and small enterprises face challenges in accessing formal finance across several countries in South-east Asia[1]. IFC’s SME Finance Forum estimates that there is a significant credit gap in case of women-owned MSMEs across the four countries as described below1

[1] Unlocking Credit For Women-Owned Enterprises in Southeast Asia through Value Chain Digitization, Women’s World Banking

Objectives

• Assess how women-led MSEs’ financing needs in these value chains are currently being served

• Assess the opportunity to develop and expand formal financial services that help women- led (MSEs) in select value chains in Indonesia, Cambodia, the Philippines and Vietnam grow their business

• Assess how expanded access to and use of financial services can help women-led MSEs grow their businesses

• Assess digital finance opportunities across shortlisted value chain on the basis of value chain transaction mapping and stakeholder analysis

• Develop a DFS ecosystem design that would best meet the need of women-MSE in selected value chains

• Identify key actors that could play a role in enabling digitization in the selected value chains and lessons on expanding access to DFS and credit for women-led MSEs

OutcomeA blue print for digitization of payments in (a) food services value chain in Indonesia and (b) garments manufacturing value chain in Vietnam.

The digitization blueprint was based on synthesis of various factors such as

• Existing levels of digitization

• Transactions flows in the value chain

• Behaviour of the value chain actors in terms of banking, savings, etc.

• Pain points associated with handling cash

• Understanding of their credit needs and gaps

• Challenges in access to finance

Intellecap formulated digitization pilot designs through extensive on-field interactions in Indonesia and Vietnam. We identified the key players as well as potential partners for implementing the digitisation programs. The recommended design focused on compelling value propositions for all stakeholders, including the financial service providers. Critical success factors needed to implement the design were also laid out.

Key insights

• The solution needs to be secure and the technology must be easy to use

• Interoperability is critical for higher adoption of a digital platform; built-in payment gateway within the same platform will be necessary

• There is a need for rationalizing high costs of digital transaction in case of inter-wallet transfers

• Regulatory reforms to overcome barriers such as wallet balance ceilings and inter-transfer charges are also required for driving adoption and sustained usage

• Ensuring ownership of the change management process while implementing the design is easy to overlook but is a critical success factor