Supporting Entrepreneurs in Africa: The role of Philanthropic Giving and Impact Investing for Social Development Goals

There are 3 billion people living on less than US$2.50 per day nearly half of the global population. These low-income families have unmet needs which tie directly with many of the Social Development Goals (SDGs) such as food (Goal 2), water and sanitation (Goal 6), shelter (Goal 11), healthcare and livelihoods (Goals 3 and 8). Philanthropic giving and impact investing both play an important role in achieving these development goals.

In Africa, the philanthropic work done by global industrial families and business houses is notable. Examples include the Bill & Melinda Gates Foundation which is one of the biggest private donors in Africa, supporting health and agricultural development and the Rockefeller Foundation has been working in the continent for over 150 years, active in health and education.

High net worth individuals in Africa have grown by 150% between 2000 and 2013, more than double the global rate which has given rise to more local formalized philanthropy over the continent. Most are channelling their giving through their businesses and private foundations for example Nigerian Aliko Dangote, who is estimated by Forbes to be worth $15.6 billion has set up the Dangote Foundation which is active in health, education and disaster relief. Other notable African philanthropists include Mo Ibrahim, Patrice Motsepe, Tony Elumelu, Strive Masyiwa and Manu Chandaria.

The continent has also emerged as a major hub and centre of innovation for social enterprises and impact investing globally. Africa was ranked the world’s second most attractive investment destination in 2013 attracting traditional, angel and other impact investors. More than US $9.3m has been disbursed by Development Finance Institutions (DFIs) and other impact investors in East Africa

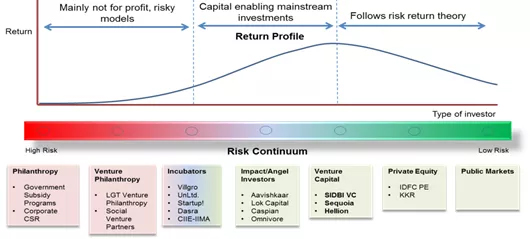

The role of both giving and impact investing as seen is best understood through the Risk Return Continuum. This continuum indicates the increasing level of risk towards the left of the spectrum given the absence of a market based solution and lack of social and physical infrastructure.

There are 3 billion people living on less than US$2.50 per day nearly half of the global population. These low-income families have unmet needs which tie directly with many of the Social Development Goals (SDGs) such as food (Goal 2), water and sanitation (Goal 6), shelter (Goal 11), healthcare and livelihoods (Goals 3 and 8). Philanthropic giving and impact investing both play an important role in achieving these development goals.

In Africa, the philanthropic work done by global industrial families and business houses is notable. Examples include the Bill & Melinda Gates Foundation which is one of the biggest private donors in Africa, supporting health and agricultural development and the Rockefeller Foundation has been working in the continent for over 150 years, active in health and education.

High net worth individuals in Africa have grown by 150% between 2000 and 2013, more than double the global rate which has given rise to more local formalized philanthropy over the continent. Most are channelling their giving through their businesses and private foundations for example Nigerian Aliko Dangote, who is estimated by Forbes to be worth $15.6 billion has set up the Dangote Foundation which is active in health, education and disaster relief. Other notable African philanthropists include Mo Ibrahim, Patrice Motsepe, Tony Elumelu, Strive Masyiwa and Manu Chandaria.

The continent has also emerged as a major hub and centre of innovation for social enterprises and impact investing globally. Africa was ranked the world’s second most attractive investment destination in 2013 attracting traditional, angel and other impact investors. More than US $9.3m has been disbursed by Development Finance Institutions (DFIs) and other impact investors in East Africa

The role of both giving and impact investing as seen is best understood through the Risk Return Continuum. This continuum indicates the increasing level of risk towards the left of the spectrum given the absence of a market based solution and lack of social and physical infrastructure.

From the Risk Return Continuum it is clear that traditional giving and venture philanthropy play a significant role in supporting traditional NGOs and social enterprises that address issues that may not get addressed by the market at all or are focused on driving deep impact within local communities but may not be very scalable or replicable. Impact investors can then take on enterprises focusing on sectors which are high risk due but with the right support and patient capital have the potential to scale resulting in a combination of profit and impact

East Africa is one of continent’s innovation hubs. The success of innovations such as M-Pesa, M-KOPA and One Acre Fund has triggered a boom of high impact enterprises working to solve development challenges whilst being sustainable businesses. As such, impact investing has a key role to play in supporting these enterprises to solve development challenges.

SDGs through Entrepreneurship

In East Africa, there has been a shift in ideology towards the use of entrepreneurship to solve development challenges with the role for impact investing growing.

Intellecap analysed over 400 social enterprises across East Africa with findings captured in the Game Changers Report (2016). The report showed that market challenges are crucial triggers for impact entrepreneurship. For example, a key issue in East Africa is the limited purchasing power of the low income population. Rather than just creating low-cost products with basic features, enterprises such as M-Kopa, Bridge International and Sanergy are designing innovative pricing and payment solutions for full-feature products and services. They use sliding fee scales or special discounts for people of lesser means or introduce new payment models such as pay as-you-go, prepay, and the franchise model to ensure services and goods are accessible to the bottom of the pyramid.

These disruptive models demonstrate how entrepreneurship can be a key tool in achieving the SDGs. For example, in addition to creating decent work and economic growth (SDG Goal 8) M-Kopa provides affordable and clean energy, (SDG Goal 7), Bridge International provides low cost, quality education (SDG Goal 4) and Sanergy sells prefabricated toilets in urban slums improving sanitation, (SDG Goal 6),

However, social entrepreneurship and impact investing is still nascent in East Africa and more than 60% of enterprises interviewed for the Intellecap report were younger than five years old. Much of the activity is concentrated in Kenya, while other countries were starting to see fledgling growth in impact enterprises. Around half of these enterprises have not achieved break-even and 67% of these enterprises earn revenues of less than US$100k.

Lack of finance was a key challenge cited by social entrepreneurs. Small ticket size investments from $100k- $500k are critical for the growth of these enterprises and currently demand for such investments outstrips supply. As such, impact investors focusing in East Africa need to design innovative financing mechanisms such as multi-year financing plans, result-based financing, and other forms of blended finance in order to cater to the growing demand. With financing and support the enterprises will be able to scale simultaneously creating profit and much needed impact to solve the SDGs.

In addition, many entrepreneurs require non-financial support such as capacity building however this needs to be contextual to the local environment. The type of support required depends on the stage of the enterprise for example there is a need for targeted interventions to support later stage enterprises. What is required is a strong entrepreneurial ecosystem across the region. An ecosystem approach is therefore recommended.

Strengthening Impact Investing: Ecosystem Approach

An ecosystem approach looks at all the factors that can enable the entrepreneur to grow and scale. The Intellecap approach for ecosystem building involves three pillars;

Capital

Intellecap research shows that 84% of early stage enterprises in East Africa are unserved or underserved, financing their venture with personal funds. Ensuring that appropriate capital is available for enterprises is essential for growth and scale. The amount and type of capital at each stage of the enterprise life-cycle changes and there is a need for blended forms of finance, including philanthropic, impact and commercial which means that different types of players from can work together, collaborating on deals, creating de-risking funding structures and exchanging deal flow.

Intellecap has set up the Intellecap Impact Investment Network bringing together high net worth angel individuals from East Africa and international and local funds interested in investing in East Africa in a co-investment model. This enables social enterprises to obtain the much required early stage capital as well as support and guidance from experienced local angels.

Business Support

In addition to capital, early stage enterprises require technical assistance and specific capacity building support to enable growth and scale. Whilst the number of passionate entrepreneurs that are dedicated to cater the development challenges articulated in the SDGs is increasing, stakeholder conversations reveal that up to 90% of start-ups do not survive the first year These early stage enterprises get less visibility than their mature peers and service providers are either expensive or provide rather generic support. Impact enterprises providing solutions in sectors such as energy, healthcare, water, sanitation or agriculture face challenges in accessing targeted support in their early days of their life cycle.

Networks

While there is an increasing number of service providers and initiatives that support enterprises, the ecosystem remains fragmented and information on support opportunities is difficult to access. Networks such as platforms for peer-to-peer exchange, learning and access to mentors can help entrepreneurs grow. Intellecap’s Sankalp forum is one such network bringing together enterprises and ecosystem players from early stage to growth.

As such, entrepreneurship as a means of achieving the SDG in Africa has great potential. Both philanthropy and impact investing have their role to play. It is only with a strong ecosystem where entrepreneurs have access to capital, support and networks will they be able to scale and actualize the SDGs.

Sheena Raikundalia

Sheena is a senior advisor with Intellecap’s consulting team in Kenya providing strategic advisory services to corporates, social enterprises, development agencies, impact investors and NGOs across the East Africa market. She has a bachelor’s degree in law from the University of Bristol and an MBA from Lord Ashcroft International Business School, UK. She has over 9 years of experience in the financial services and insurance sector for organizations across Europe and Africa.

Related Articles

-

18 April 2018

Future of Energy: India in 2050

-

18 April 2018

A Smart and Resilient City Go Hand in Hand